Thank you for your generosity!

donation information

If you wish to contribute a monetary donation, please use the information below to submit payment electronically or by check.

To donate directly to the Lewis and Clark Habitat for Humanity Affiliate

Send Checks to:

P.O. Box 705

Collinsville, IL 62234

Paypal donations are also accepted- Click the PayPal button below for fast, easy and convenient donating.

To donate directly to our Habitat for Humanity Alton, IL Chapter...

Send donation to:

LC Habitat for Humanity-Alton

PO Box 705

Collinsville, IL 62234

To Donate quickly and easily online,click the button below to use Paypal and specify “Alton, IL.”

To donate directly to our Habitat for Humanity Bond County, IL Chapter...

Send donation to:

LC Habitat for Humanity-Bond County

P.O. Box 496

Greenville, IL 62246

To Donate quickly and easily online,click the button below to use Paypal and specify “Bond County, IL.”

To donate directly to our Habitat for Humanity Collinsville, IL Chapter...

Send donation to:

LC Habitat for Humanity-Collinsville

PO Box 454

Collinsville, IL 62234

To Donate quickly and easily online,click the button below to use Paypal and specify “Collinsville, IL.”

To donate directly to our Habitat for Humanity Edwardsville/Glen Carbon, IL Chapter...

Send donation to:

LC Habitat for Humanity-Edwardsville/Glen Carbon

PO Box 355

Edwardsville, IL 62025

To Donate quickly and easily online,click the button below to use Paypal and specify “Edw/Glen Carbon, IL.”

To donate directly to our Habitat for Humanity O'Fallon, IL Chapter...

Send donation to:

LC Habitat for Humanity-O’Fallon

PO Box 93

O’Fallon, IL 62269

To Donate quickly and easily online,click the button below to use Paypal and specify “O’Fallon, IL.”

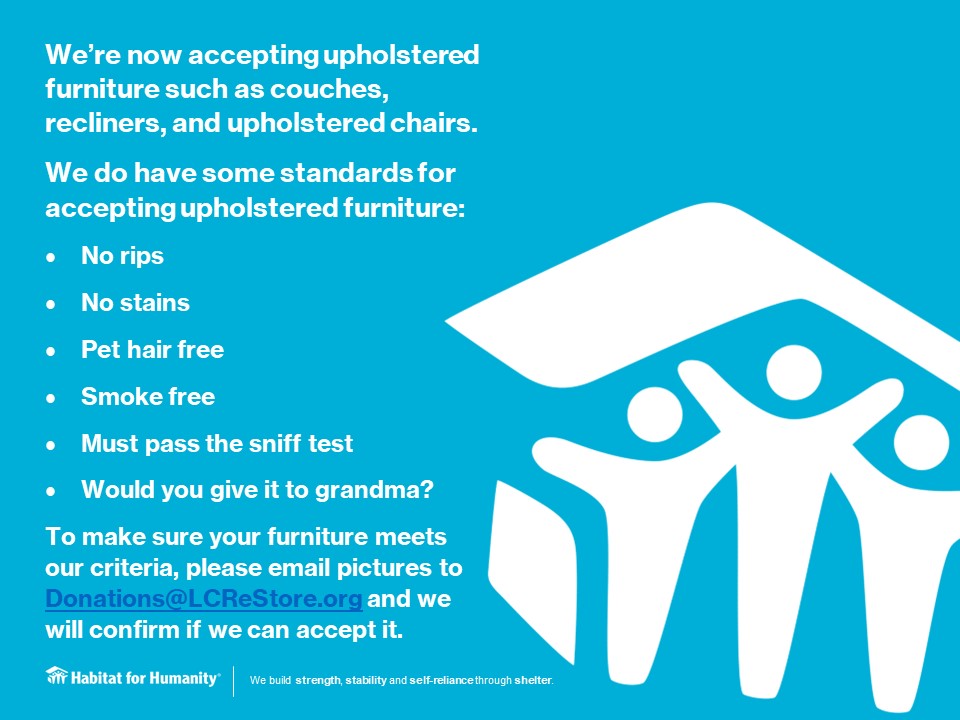

We also accept tactile/material donations at our ReStore location!

The Benefits of donating to our ReStore:

it helps build homes

When the items you donate to ReStore are sold, the proceeds help families achieve the strength, stability and independence they need to build a better future.

it helps the environment

If your items still have a usable life, then it’s not time for them to go to the landfill. The best form of recycling is keeping items in use instead of sending them to the landfill.

it helps our community

ReStore sells donated items at discounted prices to the public, offering a low cost option to repair and renovate for all who shop at ReStore, furthering Habitat’s vision of decent affordable housing for everyone.

To learn more about what you can donate and how, see our ReStore page

Cash, Check, or Credit Card donations can be accepted in person at the Lewis and Clark Habitat for Humanity Restore at 1950 Vandalia Street, Collinsville, IL 62234.

Cash or Check donations may also be mailed.

Donate a Home or Land

19 million U.S. households today pay half or more of their income on a place to live. That means 1 in 6 families are denied the personal and economic stability that safe, decent, affordable housing provides.

How can you help?

If you want to donate your land or a house to charity, Habitat for Humanity can maximize your generosity by using your donation to contribute to affordable housing for a deserving family.

Your property donation...

Can help fund our mission to build affordable housing. We are a nonprofit 501c3. Donations to 501c3’s can be tax deductible.

for more information...

about how to donate land or a home, contact:

Main Office: 618-343-0301

P.O. Box 705 Collinsville, IL 62234-0705

Or email: staff@lchabitat.org

Estate Planning

With any planned gift option you are considering, please contact your financial advisor or your attorney to get professional advice on the right plan for your lifestyle. Thank you for your support of our mission to build homes, communities, and hope for local families and Veterans.

Planned Giving: building a legacy

A legacy gift is a commitment made through your estate plans and is also known as a planned gift. By leaving a legacy gift, your commitment to people in need becomes a living tribute for children and families.

Leaving a gift of a legacy has many advantages, now and in the future:

- Lower your taxes today, regardless of your age.

- Lower your estate taxes tomorrow.

- Provide income in retirement.

- Allow you to control your assets throughout your lifetime.

- Reduce and even eliminate long-term capital gains tax.

Please consult your tax advisor to discover what legacy gift best suits you and your family. Lewis & Clark Habitat for Humanity welcomes legacy gifts in a variety of forms.

Charitable Gift Annuities

A charitable gift annuity is a gift that falls in the category of planned giving. It involves a contract between a donor and a charity. The donor transfers cash or property to the charity in exchange for a partial tax deduction. Charitable Gift Annuities make a difference in someone else’s life while providing guaranteed revenue during your retirement years. We offer competitive rates to help diversify your financial portfolio.

Leave a Gift in Your Will or Trust

Leaving a gift to Habitat for Humanity through your will or trust has many advantages. It’s simple: just add these sentences to your will or trust: “I [name], of [city, state], give, devise and bequeath to Lewis & Clark Humanity Habitat for Humanity [specific amount, percentage of estate or specific item] for its unrestricted [or restricted, please specify] use and purpose.”

Beneficiary Designations

Most assets can pass to loved ones by the terms of your will. Other assets, like IRA’s and life insurance policies are not controlled by your will and require simple but separate beneficiary forms. Designating Lewis and Clark Habitat for Humanity to receive a portion of your 401 (k) or IRA is an ideal gift because it avoids taxes to your loved ones from these tax-deferred tools, sometimes as high as 39.6% by the time it reaches them.